Flexible plans for your business size and needs

Get a 14-day free trial of Zapaut, no credit card required to sign up.

No contracts involved | 30-day money-back guarantee🎉

Try before you buy: 14 days for $0

For two weeks, enjoy free unrestricted access to our

Pro plan—no credit card required, no commitment.

Small businesses

Large Institutions

|

plan

Bootstrap

Best For

Solopreneurs $59

/month.

|

plan

Accelerate

Best For

Small businesses $149

$30

/month.

|

plan

Pro

Best for

Large Institutions $299

$50

/month.

|

|

|---|---|---|---|

|

Basics

|

|||

|

$59/ month, billed monthly

|

$149/ month, billed monthly

|

$299/ month, billed monthly

|

|

|

$54/ month, billed yearly

|

$140/ month, billed yearly

|

$282/ month, billed yearly

|

|

|

Web

|

Web,

Mobile (Android & iOS apps) |

Web,

Mobile (Android & iOS apps), 3rd-party integrations via RESTful APIs |

|

|

2,000

|

8,000

|

Unlimited

|

|

|

1,000

|

5,000

|

Unlimited

|

|

|

Self-serve store options

|

|||

|

|

|

|

|

|

|

|

|

|

|

Collections & Disbursals Services

|

|||

|

Fee: 0.9% per transaction

|

Fee: 0.9% per transaction

|

Fee: 0.9% per transaction

|

|

|

Fee: 1.5% per transaction

|

Fee: 1.5% per transaction

|

Fee: 1.5% per transaction

|

|

|

Fee: 1.7% per transaction

|

Fee: 1.7% per transaction

|

Fee: 1.7% per transaction

|

|

|

Fee: 2.5% per transaction

|

Fee: 2.5% per transaction

|

Fee: 2.5% per transaction

|

|

|

Fee: 3.5% per transaction

|

Fee: 3.5% per transaction

|

Fee: 3.5% per transaction

|

|

|

Fee: 3.5% per transaction

|

Fee: 3.5% per transaction

|

Fee: 3.5% per transaction

|

|

|

Fee: 2.0% per transaction

|

Fee: 2.0% per transaction

|

Fee: 2.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 0.8% per transaction

|

Fee: 0.8% per transaction

|

Fee: 0.8% per transaction

|

|

|

Fee: 1.2% per transaction

|

Fee: 1.2% per transaction

|

Fee: 1.2% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 3.0% per transaction

|

Fee: 3.0% per transaction

|

Fee: 3.0% per transaction

|

|

|

Fee: 1.5% per transaction

|

Fee: 1.5% per transaction

|

Fee: 1.5% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Mobile Banking Services

|

|||

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

Fee: 1.0% per transaction

|

|

|

Advanced analytics,

insights, and reports |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Data up to 3 months

|

Data up to 2 years

|

Data up to 5 years

|

|

|

Member Engagement

& Communication Tracking |

|||

|

Mobile banking, USSD, SMS,

and third-party integrations |

Mobile banking, USSD, SMS,

and third-party integrations |

Mobile banking, USSD, SMS,

and third-party integrations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

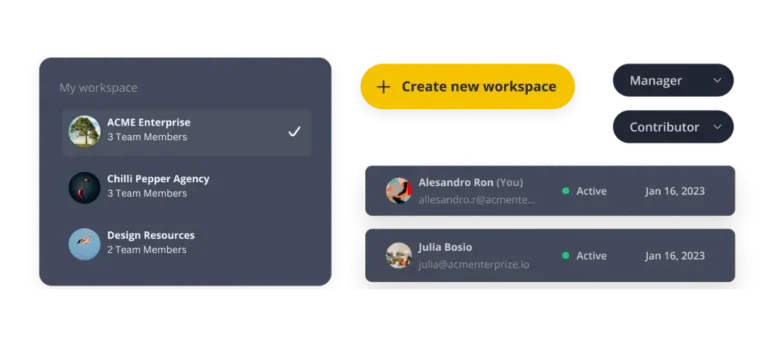

Team collaboration

|

|||

|

1 workspace

|

10 workspace

|

Unlimited workspace

|

|

|

1 user per workspace

|

10 user per workspace

|

Unlimited user per workspace

|

|

|

|

|

|

|

|

|

|||

|

Integrations

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buy Additional add-ons

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|