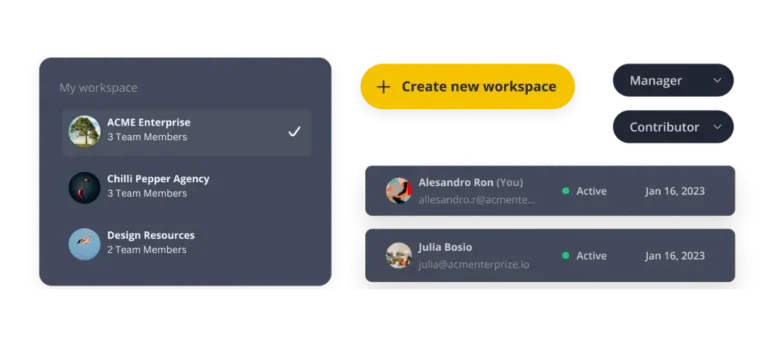

Affiliate Program

Supported Investor Content Types

Share short MP4 or MOV videos (under 3 minutes, 50 MB) to highlight Zapaut solutions, partner benefits, or affiliate offers.

Upload and schedule a series of videos to showcase product features, partner success stories, or promotional campaigns.

Add up to 12 visuals—such as product screenshots, infographics, or impact photos—that help affiliates attract and engage new clients.

Pair short video updates with compelling captions that explain affiliate incentives, product highlights, or customer success cases.

Post up to 12 images with descriptive captions—ideal for presenting affiliate promotions, program benefits, or user impact stories.

Easily generate compelling captions and promotional messaging for your Mifos affiliate campaigns. Highlight value, attract leads, and drive engagement with AI-crafted content.

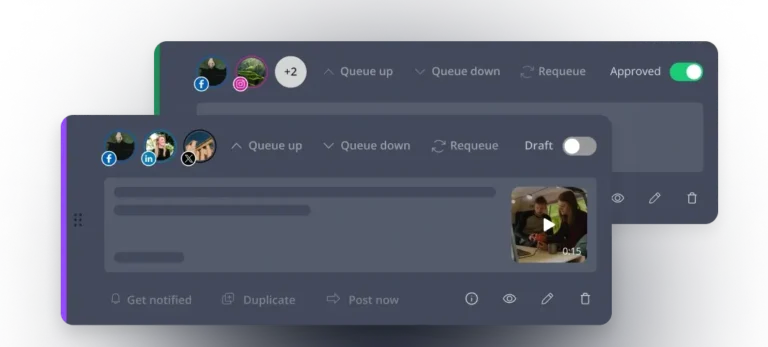

Organize your affiliate posts into categories such as Product Features, Partner Benefits, Client Success Stories, and Promotions. Rotate them strategically to keep your audience informed and engaged.

Adapt your content for each channel—refine character count, add hashtags, and create multiple caption variations with AI. Keep your Zapaut affiliate promotions fresh, relevant, and platform-ready.

Control how your affiliate content is shared—adjust visibility, and manage interactions to ensure your Zapaut promotions reach the right audience in the right way.

Plan customized posting schedules across different channels. Share your Zapaut affiliate updates at optimal times to maximize reach, engagement, and conversions.

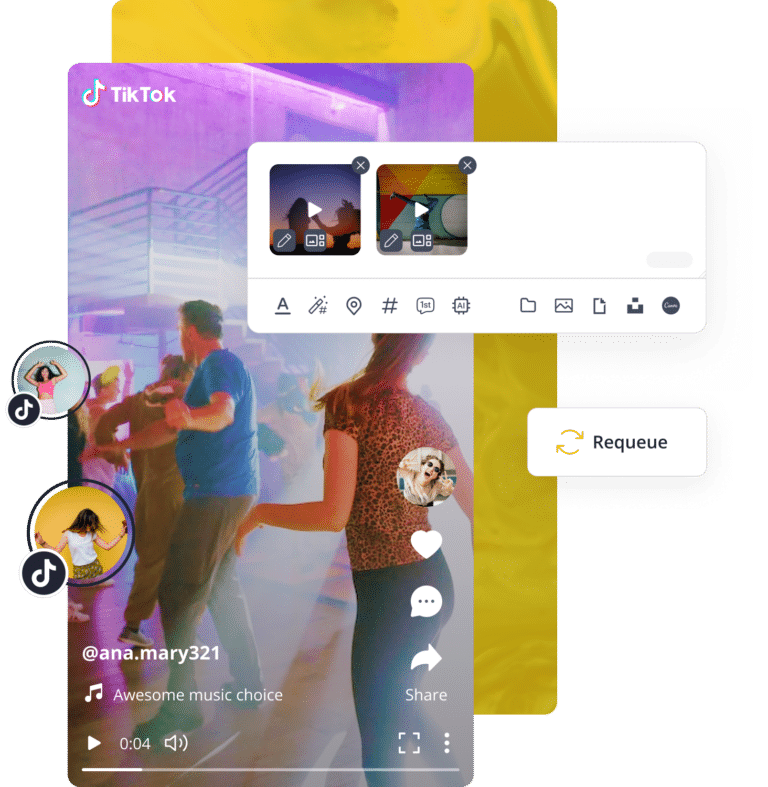

Make the most of your high-performing posts. Recycle evergreen content such as program benefits, client success stories, and product highlights to keep your audience consistently informed and inspired.